Headline-driven volatility characterized the third quarter of 2019, with bonds posting higher gains than equities1. The S&P 500 was up 1.7% for the quarter, and bonds1 were up 2.27%. Ups… The Federal […]

What do tariffs mean for my investments?

The stock market has seen both positive and negative volatility over the past few weeks as headlines have focused on trade tariff announcements between the United States and China. While this has been a recurring theme throughout 2018 and 2019, investors have seen their account balances fluctuate and may be wondering: “What has occurred, and what does it mean for my investments?”

Despite headlines, markets are up

Quarterly Performance Despite increasing trade tensions, geopolitical turmoil, and downward revisions to global growth forecasts, nearly all asset classes posted positive returns in the second quarter. The S&P 500 was […]

A case for international on America’s Independence Day

Happy 4th of July! This week, as we celebrate the birth of this country and all things USA, we’d like to spend a moment focusing on other parts of the […]

Recessions…misunderstood?

Over the last 70 years, the U.S. has experienced 11 recessions. Recessions have become less frequent since the Federal Reserve got ahold of inflation in the 1980s and learned to […]

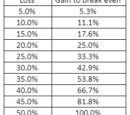

Long-term strategy using short-term numbers

The first quarter of 2019 offered the antithesis of the last quarter of 2018. Global equities rallied, up over 12%1 in the first three months of the year, while global […]

A ten-year lookback

Global markets have soared in the first two months of the year. Investors have regained their confidence in the Federal Reserve’s monetary policy, and markets seem to have priced in […]

Volatility returns for investors – but that’s actually the norm

In many ways, 2018 was a paradox of a year. US equities and 10-year Treasuries both had negative returns, which almost never happens. Cash was the highest performing asset class […]

What’s Slowing Santa’s Sleigh?

With the approach of the Holiday Season, many investors are wondering if they will enjoy a “Santa Claus” rally in the final weeks of 2018. So far, the […]

Happy Holidays and Merry Cryptocurrencies

As we find ourselves in the middle of the holiday season attending various holiday parties, family gatherings, ugly sweater contests, and open houses, invariably, conversation turns to the stock market. […]