As we all settle into a new normal, we hope you and your loved ones are well. Isn’t that really what investing is about? It’s about storing up for the future to provide for ourselves and those we care for, or maybe a charitable cause or a personal dream. Uncertainty is high in the current environment, but we believe this, too, shall (eventually) pass.

FAQ: the Volatility of Oil

Given the recent extreme volatility of oil prices. We’ve put together a FAQ list to help you stay informed.

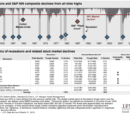

Coronavirus Fears Drive Markets Lower – Assessing the Recent Market Selloff

While the coronavirus is the main culprit behind the recent selloff, there are other factors that have likely also contributed to market volatility: the upcoming 2020 presidential election, elevated equity valuations and the inverted yield curve.

2019 Commentary: Maintaining course in uncertain times

At the end of 2018, we encouraged investors to stay disciplined and stay invested with the reminder that over time, cash is the worst performing asset class. While we weren’t specifically predicting it for 2019, cash returned to its place at the bottom of the return chart for the year.

Gold: Setting the record straight

Upon rising nearly 20 percent over the past 12 months, gold prices are making headlines and sparking intrigue among investors. While investors may be tempted to associate increased equity volatility (as measured by the VIX Index) to gold’s recent price appreciation, we examine how gold has historically performed in different market periods.

Market Commentary | Third Quarter 2019

Headline-driven volatility characterized the third quarter of 2019, with bonds posting higher gains than equities1. The S&P 500 was up 1.7% for the quarter, and bonds1 were up 2.27%. Ups… The Federal […]

Despite headlines, markets are up

Quarterly Performance Despite increasing trade tensions, geopolitical turmoil, and downward revisions to global growth forecasts, nearly all asset classes posted positive returns in the second quarter. The S&P 500 was […]

A case for international on America’s Independence Day

Happy 4th of July! This week, as we celebrate the birth of this country and all things USA, we’d like to spend a moment focusing on other parts of the […]

Recessions…misunderstood?

Over the last 70 years, the U.S. has experienced 11 recessions. Recessions have become less frequent since the Federal Reserve got ahold of inflation in the 1980s and learned to […]

Long-term strategy using short-term numbers

The first quarter of 2019 offered the antithesis of the last quarter of 2018. Global equities rallied, up over 12%1 in the first three months of the year, while global […]