By Jack Davidson, CPA, CFP® On Tuesday, December 19th, the House passed the tax reform bill with a vote of 227-203. The tax bill hit a late snag on Tuesday […]

It’s Time to Look at Year-end Planning

As the year draws to a close, we begin to think about taxes and planning for the upcoming year. There’s no telling what the tax rules will be for 2018, […]

Tax Reform for Nonprofits

The U.S. House of Representatives passed the long anticipated tax reform bill over two weeks ago on Thursday, November 16th. While the new taxation rates for both corporations and individuals […]

2018 Contribution Limits

Getting Your Affairs in Order

Recently someone was complementing these articles and said how valuable the information in them was to them. One of her family members died recently and she wanted to make sure that […]

Unwinding the Federal Reserve’s Monetary Policy and How It Can Impact Your Portfolio

Following the 2008 financial crisis, the Federal Reserve enacted numerous monetary policies to help stimulate the fragile US economy. The Fed aggressively cut the short-term federal funds rate to nearly […]

The Trust Company Newsletter | Fall 2017

How to Tell the Difference Between a (Tax) Plan and a Wish

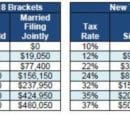

Yesterday, the much-anticipated Republican tax plan was released to the public. Many hoped this document would provide specifics about what tax reform might actually look like. However, this latest draft […]

Planning in advance for a disaster

With all the disasters that have happened recently, it never hurts to make sure that we are prepared for the worst. The Federal Emergency Management Agency, the American Red Cross […]

Equifax Security Breach – What to do??

We want to pass along info on the Equifax security breach and what steps to consider even though THE TRUST COMPANY HAS NOT HAD A SECURITY ISSUE . We encourage you to read […]

- « Previous Page

- 1

- …

- 33

- 34

- 35

- 36

- 37

- …

- 44

- Next Page »