In most cases, it is to your advantage to delay drawing Social Security benefits until you reach age 70. Your benefit amount increases by 8% each year that you wait […]

529 plan’s less popular cousin – the Coverdell ESA

We’re continuing our education series with a closer look at Coverdell ESAs. Before 529 plans were expanded to include K-12 tuition, Coverdell ESAs were a popular way to save for both college and secondary education expenses. Coverdells have […]

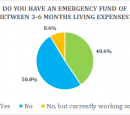

How much should be in an Emergency Fund?

Emergency funds are one of those things, like car insurance or a repair warranty, that feels painful to fund or pay for but comes in super handy when you find […]

Navigating divorce settlements in uncertain times

Divorce is wrought with emotions – fear, uncertainty, maybe even anger. Add a global pandemic and bear market to the mix and it can be nearly impossible to feel as if you are making any decisions with clarity. What should you do?

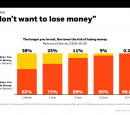

Roth conversions on sale

Chances are your IRA has a lower market value today than it did at the start of the year. No matter your age or retirement timeframe, this can be a hard pill to swallow. While the current market environment may only seem to bring negative thoughts of retirement to mind, there may be a silver lining to those who choose to take a long-term perspective in the midst of uncertainty. In fact, we would challenge you to view the market today as if everything were on sale, including Roth Conversions.

CARES Act Important Notice to IRA Owners

We hope you are staying safe and healthy. The confusing landscape of this environment is changing day by day, even hour by hour. Rest assured, however, that we are still here and working for you. You are on our minds and we have you covered. On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (CARES Act) was signed into law. The Cares Act contains a long list of features that are meant to buffer you from the hardships that are arising during this unprecedented time. We know you have questions about how the Cares Act impacts your IRA. We want to take a few moments to answer some of these questions.

Focus on what you can control

Times of uncertainty such as these may fill you with uneasiness and a desire to do something – anything! Instead of selling off all of your investments and hiding your cash in a coffee can in the back yard, here is a list of productive financial actions you can do now to take advantage of a bear market.

Talking about money with your spouse

February – the month of love. This month, let’s switch gears from talking about divorce to talking about how to have productive conversations with your spouse about money. “Money Issues” is consistently named as one of the top causes for divorce, after all, and even when you are happily married having conversations about your finances can be difficult. Like anything in marriage, it takes consistency and dedication to get on the same page financially.

Education Savings Tools – how to choose a savings option

College is quickly becoming more and more expensive. Learn about a few options you have to make the most of your planning and investment in the future.

2019 Commentary: Maintaining course in uncertain times

At the end of 2018, we encouraged investors to stay disciplined and stay invested with the reminder that over time, cash is the worst performing asset class. While we weren’t specifically predicting it for 2019, cash returned to its place at the bottom of the return chart for the year.

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 8

- Next Page »