We hope you are staying safe and healthy. The confusing landscape of this environment is changing day by day, even hour by hour. Rest assured, however, that we are still here and working for you. You are on our minds and we have you covered. On March 27, 2020, the Coronavirus Aid, Relief and Economic Security Act (CARES Act) was signed into law. The Cares Act contains a long list of features that are meant to buffer you from the hardships that are arising during this unprecedented time. We know you have questions about how the Cares Act impacts your IRA. We want to take a few moments to answer some of these questions.

Focus on what you can control

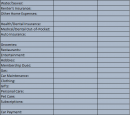

Times of uncertainty such as these may fill you with uneasiness and a desire to do something – anything! Instead of selling off all of your investments and hiding your cash in a coffee can in the back yard, here is a list of productive financial actions you can do now to take advantage of a bear market.

Education Savings Tools – how to choose a savings option

College is quickly becoming more and more expensive. Learn about a few options you have to make the most of your planning and investment in the future.

Conversations with your Kids about College and Money

According to a survey completed by TD Ameritrade in 2019 on the “Boomerang Generation”, 50% of young millennials (aged 22-28) plan to move back home after college. 1 in 3 […]

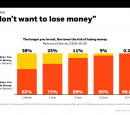

Resolve to make better decisions with money

New Year’s resolutions often address behavior changes such as exercise and diet. But your financial health has a big impact on your overall well-being.

SECURE Act – How are you affected?

With the passing of the SECURE (Setting Every Community Up for Retirement Enhancement) Act at the end of December, you may be asking how or if this impacts your financial plan. A few of the bigger changes are highlighted here.

New Year – New Financials

As we start a new decade in the new year, below are a few simple ideas to give your financial life a head start. Reassess Your Goals – Reassessing your […]

Are health savings accounts just what the doctor ordered?

Health savings accounts (HSAs) are the best savings and tax strategy in many years because they are triple tax-free.

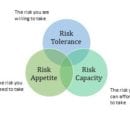

How should I be invested?

One of the most common questions advisors are asked is “How should I be invested?” and unfortunately, there isn’t a simple answer. Determining asset allocation is not a “one-size fits […]

A planning process for future success

Do not act as if you had ten thousand years to throw away. Death stands at your elbow. Be good for something while you live and it is in your […]