The latest NHC 401(k) plan enhancements give partners flexible options for saving for retirement. Log in to your account to change your contribution type to Roth, edit your election to a percentage, view your account balance and generate an on-demand statement.

CLICK HERE to view a recorded webinar about plan enhancements.

Introducing Roth Contributions

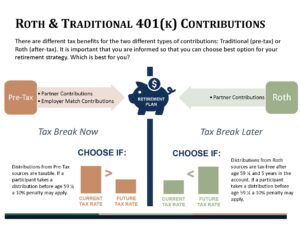

Partner contributions can be either Roth or traditional. NHC’s matching contribution are traditional (pre-tax). Having both types of funds allow tax planning opportunities to and through retirement. Consult your financial advisor when deciding which type of contribution to make.

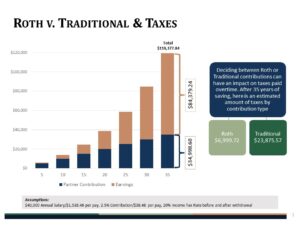

The chart on the left illustrates potential growth in a 401(k) plan. Depending on if the contributions were Roth or traditional, different tax amounts were paid. If the partner contributions were pre-tax, taxes would be paid on the total balance: $119,377.84. If the partner contributions were Roth, taxes would be paid on the partner contributions only: $34,998.60.

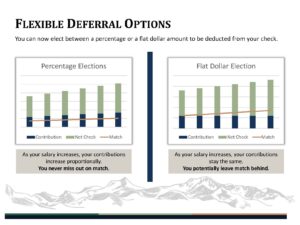

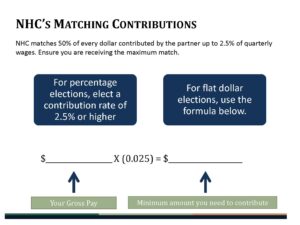

Percentage & Dollar Contribution Elections Available

Selecting a percentage election allows contribution amounts to adjust as pay fluctuates. Selecting a flat dollar election keeps contribution amounts predictable.

NHC’s match is calculated based on a percentage of partner contributions: 50% of every dollar up to 2.5% of quarterly wages. A contribution rate of 2.5% or more will ensure the maximum match is received. As your pay increases, a flat dollar election might fall under the required contribution amount needed to receive the full match.

Daily Account Valuation

401(k) account balances will now update each business day based on the close of market value from the previous business day. Consult your investment advisor when making investment decisions; keep long-term investment goals in mind when making changes.

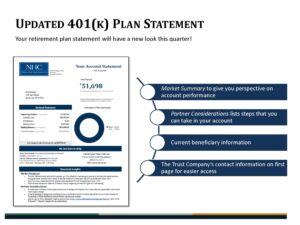

NHC’s 401(k) plan statements are getting a new look! Market commentary & retirement plan announcements will now be included in your quarterly statement. Opt into electronic statement delivery by logging into your account.