Imagine building your business over several decades, beginning to plan your business exit, then dying unexpectedly before you can implement your plans. Business owners rarely think about how an unexpected […]

Why You’ll Need an Advisor Team

Exit Planning can be complex. Between setting your exit goals and transferring your business, you’ll attempt to build business value, find an appropriate successor or buyer, navigate perplexing tax implications, […]

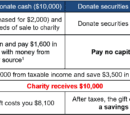

Charitable Giving: Not a One Trick Pony

The beginning of a new year presents an opportunity for investors to recalibrate and review their goals. Often among these is a renewed endeavor to give back in a charitable […]

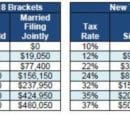

How the New Tax Structure Affects You

In late 2017, Congress passed a new tax law that will affect your taxes in 2018. There were many changes to the tax structure, both for people and businesses that […]

Tax Reporting Mailing Dates

Important dates for taxes this year: Tax Form Mailing Dates – 2018

Tax Reform Arrives

By Jack Davidson, CPA, CFP® On Tuesday, December 19th, the House passed the tax reform bill with a vote of 227-203. The tax bill hit a late snag on Tuesday […]

Tax Reform for Nonprofits

The U.S. House of Representatives passed the long anticipated tax reform bill over two weeks ago on Thursday, November 16th. While the new taxation rates for both corporations and individuals […]

Tennessee Tax Changes That Could Affect You!

Last year, Tennessee’s legislators and Governor enacted a repeal of the TN Hall Tax effective 2022 and a reduction of the rate from 6% to 5% beginning January, 1 2016. […]

Tax Reporting Mailing Dates

Click Here for 2017 Tax Form Mailing Dates

Investment advice: Tax deadline is good time to assess your financial plan

Originally published by Chattanooga Times Free Press by Andy Muldoon, Senior Vice President Oh those deadlines! Just when you thought you knew all those tax return or extension deadlines, here […]